29+ California Bonus Tax Calculator

Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. Web If you make 55000 a year living in the region of California USA you will be taxed 11676.

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

If you make 70000 a year living in the region of California USA you will be taxed 15111.

. Web The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. Your average tax rate is 1198 and your. Web This California bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as.

Web Fast easy accurate payroll and tax so you can save time and money. If your employee makes more than 1 million in. And you decide to pay her a 1500000 bonus.

Web If you use flat withholding for bonuses you will simply apply a tax rate of 22 and pay the bonus by separate check. Web California Income Tax Calculator 2021. Web No really really good.

Tax calculator is for 2022 tax year only. The TAX WITHHOLDING is different but the actual TAX is calculated when the return is filed. Use the Free Paycheck Calculators for any gross-to-net calculation need.

The first million will be subject to that same 22 tax making the withholding 220000 taking it. It says that bonuses may be taxed at a higher rate or will be taxed at a flat 25 rate. The wording in the bonus calculator is incorrect.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50. Web The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Web Californias notoriously high top marginal tax rate of 133 which is the highest in the country only applies to income above 1 million for single filers and 2 million for joint.

Web Calculate your 2022 tax Quickly figure your 2022 tax by entering your filing status and income. That means that your net pay will be 43324 per year or 3610 per month. Web December 17 2014 at 555 pm.

This calculator uses the. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. With this tax method the IRS taxes.

Do not use the calculator for 540 2EZ.

What Are The Tax Implication In Indian Stock Market Quora

G2210711ksi001 Gif

10424461 Jpg

Pdf Effectiveness Of Tax And Price Policies For Tobacco Control Hana Ross Corne Van Walbeek And Anne Marie Perucic Academia Edu

Bonus Tax Calculator Percentage Method Primepay

Bonus Tax Calculator Percentage Method Business Org

Key West Weekly 22 1124 By Keys Weekly Newspapers Issuu

Le Dieu Linh Human Resources Generalist Codix Linkedin

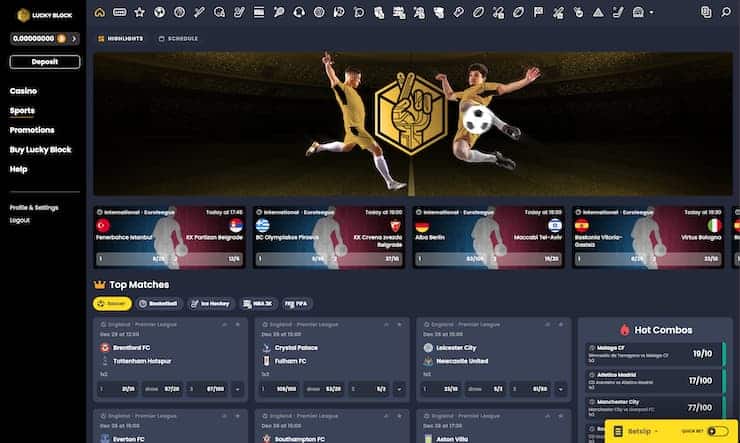

Online Betting Kuwait 10 Best Sports Betting Sites For Kuwaitis

Anuj Kumbhat Posted On Linkedin

What Are The Tax Implication In Indian Stock Market Quora

Phormed Startengine

Irmjcr

Tax On Bonus How Much Do You Take Home Uk Tax Calculators

Progress Bulletin From Pomona California On April 1 1968 Page 40

Quản Trị Học Quản Ly Phục Lục Exams Economics Docsity

California Paycheck Calculator Smartasset